Enable’s encounter it—acquiring the appropriate insurance policy Resolution can come to feel like navigating a maze that has a blindfold on. You’re surrounded by terms you barely have an understanding of, fantastic print that can rival a novel, and options that all seem to be similar but guarantee greatly distinctive outcomes. Seem common? You're not by itself. Plenty of people battle with figuring out which insurance policies Alternative fits their everyday living like a glove. And Actually, that’s why this subject matter warrants a deep dive.

Picture this: you’re purchasing a automobile. You wouldn’t just decide the main one that appears shiny, correct? You’d glance underneath the hood, test travel a couple of, and Examine selling prices. It’s exactly the same with insurance coverage. An insurance policies Resolution isn’t merely a plan; it’s comfort packaged in a means that’s supposed to make your daily life easier. But Except you really know what You are looking for, it could quickly turn into a fiscal headache.

Not known Details About Insurance Solution

So what precisely helps make a great insurance Answer? It is about extra than simply selling price. You want protection that really performs when lifetime throws a curveball. Think of well being insurance coverage that truly pays out if you have to have it most, or household coverage that doesn’t leave you high and dry after a storm. It’s the real-environment overall performance of that policy that separates the winners in the duds.

So what precisely helps make a great insurance Answer? It is about extra than simply selling price. You want protection that really performs when lifetime throws a curveball. Think of well being insurance coverage that truly pays out if you have to have it most, or household coverage that doesn’t leave you high and dry after a storm. It’s the real-environment overall performance of that policy that separates the winners in the duds.Enable’s crack it down: not all insurance answers are produced equivalent. Some are like all-inclusive vacations—every little thing you require in a single neat offer. Other folks are more à la carte—you pick and opt for what you need, but you better study the menu cautiously. The very best insurance coverage Alternative is the one particular that fits your Way of living, your funds, plus your tolerance for hazard.

Below’s the thing—insurance policy isn’t sexy. No-one’s bragging with regards to their new everyday living insurance coverage system in excess of brunch. But it’s considered one of the smartest Grownup choices you may make. A great insurance policies solution could help you save from fiscal damage, whilst a foul one can increase pressure to an currently demanding problem. It's like owning an umbrella when it pours—guaranteed, you may not will need it every day, but whenever you do, you'll be glad you have it.

Enable’s talk have confidence in. For the reason that choosing the suitable insurance policy Alternative is really about rely on. You’re Placing your monetary foreseeable future in someone else’s arms. So talk to oneself: Does one have faith in the corporate guiding the policy? Are their opinions reliable? Do they pay out promises rapidly? If the answer’s no, that low-cost high quality may return to Chunk you later on.

At any time observed how distinct your needs are now compared to 5 years ago? Daily life alterations. So should really your coverage. What labored after you had been one and residing in a little condominium may not Lower it as soon as you’ve obtained a home finance loan and two Young ones. Your coverage Option must evolve along with you, like a wardrobe that modifications While using the seasons.

A person sizing would not in good shape all. Your neighbor’s insurance coverage solution may very well be ideal for them but completely Completely wrong for you personally. Possibly they’re possibility-takers and also you’re a lot more careful. Possibly they drive a Tesla so you’re happy with your outdated Honda. In any case, copying some other person’s coverage is like carrying their sneakers—it’s likely to come to feel off.

Let’s get private. Are you aware of what’s truly covered under your present-day program? Many people don’t. And that’s a challenge. Mainly because when you don’t know what you’re purchasing, How are you going to make certain it’s Find out more the right insurance Answer for you personally? Dig into the small print. Request issues. Don’t prevent until you get answers that sound right.

Consider your insurance plan Answer similar to a puzzle. Every piece—auto, wellness, residence, lifetime—has to fit jointly. Overlap too much, and you’re paying added. Leave gaps, and you simply’re uncovered. Coordinating your coverage isn’t just clever; it’s essential. It’s like building a basic safety Internet with no holes.

Technology has improved the game. Lately, finding an ideal insurance policy Resolution is easier than previously. On line instruments Allow you to Assess guidelines, browse genuine user assessments, and also personalize protection which has a couple clicks. It really is like looking for coverage in your pajamas. And Truthfully, who doesn’t appreciate that?

But here's the kicker: far more choice doesn’t often suggest much better alternatives. In reality, it may result in analysis paralysis. With lots of choices, it’s easy to get overcome and just choose no matter what Seems very good in The instant. That’s why it can help to get started with your priorities. What issues most—Price, protection, customer service? Rank them. Then use that record as your information.

Not known Factual Statements About Insurance Solution

Permit’s not ignore the elephant See details in the area—selling price. Absolutely everyone needs The most affordable insurance policies Remedy, but much less expensive doesn’t often indicate far better. A reduced premium might preserve you funds now but cost you huge afterwards when it refuses to pay for out. Consider it like purchasing a knockoff telephone charger: positive, It truly is less costly, but it might blow up in your confront.There’s also timing to consider. The most effective time to find an insurance coverage Alternative is in advance of you really need to have it. Sort of like installing a smoke detector ahead of the hearth, not just after. Procrastinating could leave you scrambling inside of a crisis—Which’s The very last thing you'd like when feelings are substantial.

Permit’s get a little bit emotional below. Coverage isn’t merely a money tool; it’s a means to protect the folks and stuff you care about. Your loved ones, your house, your health. That’s the heart of it. A great coverage Remedy isn’t about worry—it’s about really like, responsibility, and reassurance.

And what about enterprises? Yep, they require insurance policies alternatives too. From mom-and-pop shops to large corporations, possessing the best coverage can imply the difference between bouncing back or going belly-up. Continue reading Organization insurance policies isn’t merely a formality; it’s a survival strategy.

Still perplexed about in which to start out? Begin with a checklist. Compose down what you might want to defend, Everything you can afford to pay for, and what challenges you are willing to consider. Then match that checklist towards the coverage possibilities obtainable. Don’t be afraid to request assist—insurance coverage agents exist for your motive, and a fantastic one may make the procedure way significantly less unpleasant.

Below’s a pro suggestion: evaluation your insurance coverage solution no less than annually. Issues change—new work, new newborn, new residence—plus your coverage has to sustain. Treat it like an everyday health and fitness check-up. Dull? Probably. But definitely worthwhile.

Let's say you already have protection nevertheless it doesn’t really feel correct? Have faith in your gut. If a thing looks off, it possibly is. Don’t be scared to switch vendors or renegotiate conditions. You wouldn’t remain in a romance that wasn’t Doing the job, right? Your insurance plan Answer warrants exactly the same standard of scrutiny.

6 Simple Techniques For Insurance Solution

At last, recall this: the most beneficial coverage Resolution would be the just one you realize. If a coverage sounds far too complex or makes use of jargon You can not decode, it’s likely not the appropriate match. The whole position of insurance is to cut back strain, not include to it. So come across a solution that speaks your language and offers you self-assurance, not confusion.

Mara Wilson Then & Now!

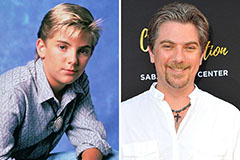

Mara Wilson Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!